Outlook Tip: Calculating Dates

By JC Kadii, Mortgage Virtual AssistantSM

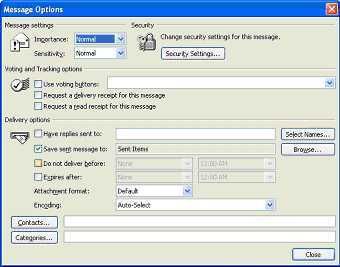

In a previous Outlook tip, Compose Now, Send Later, I talked about using Outlook’s Message Options feature to send an email at a later date.

Here’s another shortcut that I use when:

- scheduling a Message for future delivery,

- setting appointments in Calendar, or

- setting deadlines in Tasks.

Did you know Outlook saves you the hassle of looking up a date? If you want to set a task deadline for 6 weeks from now, for example, all you have to do is type +6w in the due date field. Outlook automatically calculates the dates for you.

Here are some other date shortcuts:

- d: days

- h: hours

- m: minutes

- mo: months

- y: years

So, 90 minutes from now will be entered as +90m.

Hope you find this helpful.

JC Kadii, Mortgage Virtual AssistantSM . Through http://www.close-more-loans.com/, JC leads a team providing top notch administrative, internet marketing, and technology services to mortgage professionals. Mortgage professionals are encouraged to visit the website and sign up for the More Closings email newsletter to receive the report 6 Steps to More Referrals.

One of my guiding principles is my belief that time is priceless. So, I am not one for jumping on this or that social media or tech marketing bandwagon, or recommending them to my clients.

One of my guiding principles is my belief that time is priceless. So, I am not one for jumping on this or that social media or tech marketing bandwagon, or recommending them to my clients.